Lawmaker proposes 1000% tax on semi-automatic guns

Gun control has been a much debated topic in the US for years. This is understandable considering the total number of gun deaths in the US and the mass shootings which receive frequent attention from the media.

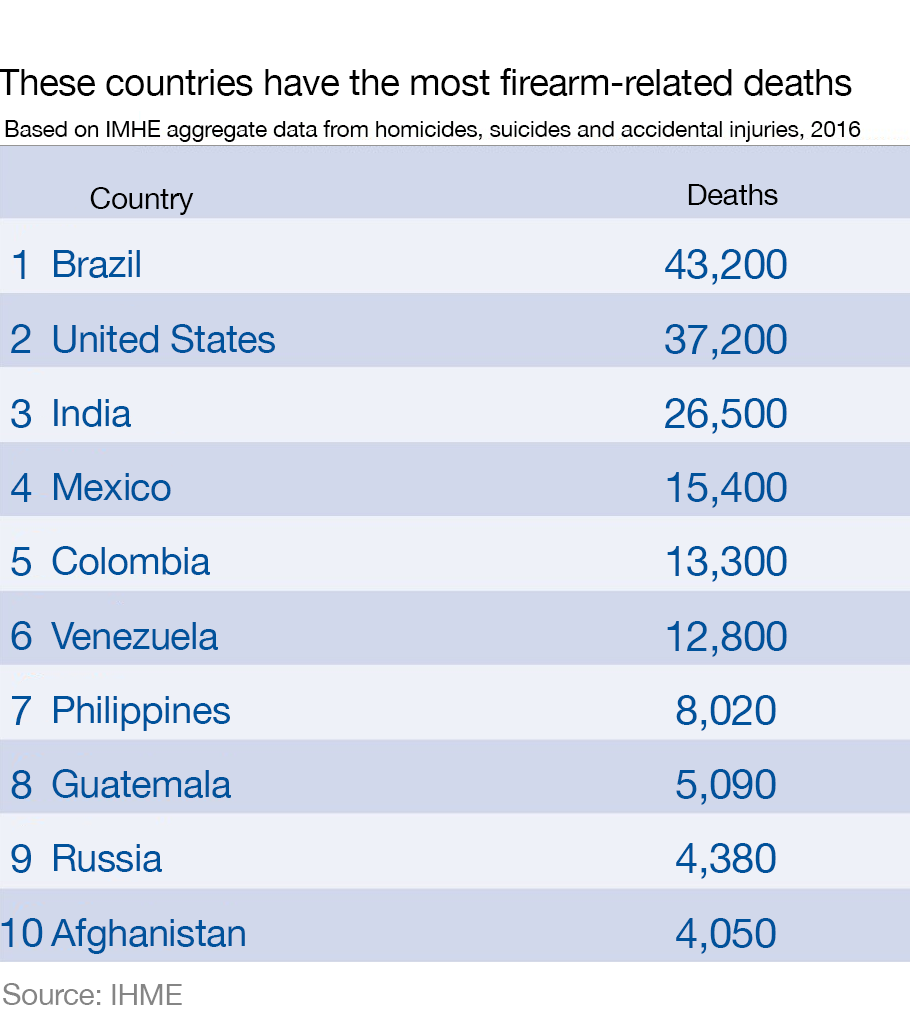

In 2016, the total number of gun deaths in the US (37,200) was second only to Brazil (43,200), a country where poverty, criminal gangs and a vibrant drug-trafficking industry are extremely prevalent.

Many people assume that the high number of gun deaths in the US is due to mass shootings. However, mass shootings account for only a small percentage of gun deaths. In fact, 63% of gun deaths in 2022 were suicides.

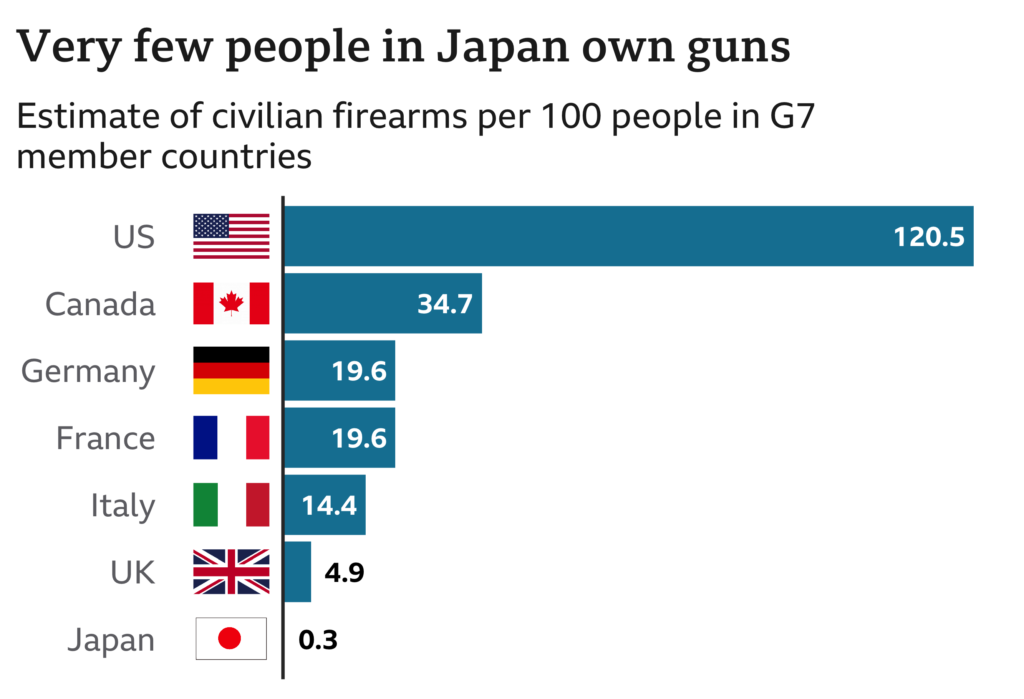

There are 120.5 guns per 100 people in the US compared to 0.3 guns per 100 people in Japan. This is because the US has some of the most relaxed rules in the world when it comes to buying guns. You can buy a gun within hours from the local Walmart after completing a very basic background check.

But for Japanese citizens to purchase a gun, they must attend an all-day class, pass a written exam, and complete a shooting range test, scoring at least 95% accuracy. Candidates will also receive a mental health evaluation, performed at a hospital, and will have a comprehensive background check done by the government. The class and exam must be retaken every three years.

Most US lawmakers are against the complete banning of semi-automatic guns like AR-15s (pictured to the right), which have been used in many mass shootings.

A Democratic lawmaker, Don Beyer, proposed that a 1000% tax should be imposed on all semi-automatic guns. If passed, the legislation would make semi-automatic guns too expensive for most buyers. The current retail price of an AR-15 is $1,870.

Currently, all guns in the US – both handguns and semi-automatic guns – are taxed at a rate of 10%. Handguns are responsible for 70% of all gun-related deaths in the US.

Aside from the lives lost, guns cause about 80,000 non-fatal injuries each year. It is estimated that the social cost of guns exceeds $300 billion each year.

Even so, US gun production has tripled since 2000. In 2022, the US gun industry employed almost 350,000 people directly or indirectly, and contributed $51.3 billion to the economy.

Questions

- Examine the negative externalities associated with the consumption of guns. (8)

- Discuss whether the 1000% indirect tax imposed on semi-automatic guns is the best solution. Use an appropriate externalities diagram in your answer. (12)

- With reference to the article, explain the difference between positive and normative statements. (5)

Question 1:

- What is a negative externality?

- What are two potential negative externalities in this example?

- Why might the negative externalities not be so large? What are the positive externalities?

- Knowledge (2), application (2), analysis (4), evaluation (4)

- What is an indirect tax?

- Draw the externalities diagram showing the impact of the tax.

- What happens to price, quantity, welfare loss, tax revenue?

- Why might the indirect tax be ineffective? What problems might the tax cause?

- What are positive and normative statements? What’s the difference?

- Can you find examples of each?