The story of exploding kittens

The best-selling card game “Exploding Kittens” was created by two former Microsoft Xbox employees and now sells for $19.99 on Amazon.

But in the beginning, as a small start-up company, they struggled to raise enough money to get the card game to market. Luckily, they found a solution …

The two Microsoft employees posted their “Exploding Kittens” card game idea to a website called Kickstarter – a website used by start-up businesses to find investment for their new business ideas.

In the beginning, they only wanted to raise $10,000, but they actually managed to raise an amazing $1 million in just seven hours!

By the end of the fundraising, they managed to raise $8.7 million from a total of 220,000 individual investors from all around the world.

The cool thing about raising money from websites like Kickstarter is that you don’t have to pay the investors back with money.

The creators of “Exploding Kittens” thanked all their investors by giving them copies of the game!

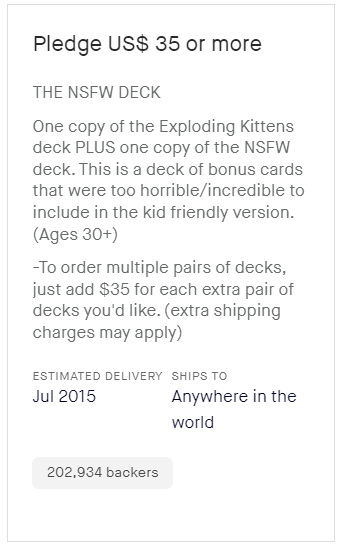

People that invested $20 were rewarded with the basic version, while people that invested $35 were given the basic version AND the NSFW (not-suitable-for-work) version of the game.

Another example of a business successfully raising money using external finance is Uber.

Although Uber now operates in over 70 countries, its founder – Travis Kalanick – also found it very difficult in the beginning to raise enough finance to expand into different cities.

Raising enough finance was difficult because the company was too small to get a large bank loan and the limits on a bank overdraft and credit card were too small.

Luckily, in 2010, a venture capital firm called First Round Capital was willing to take a risk to help out Uber. They helped Uber to expand by giving $1.25 million in exchange for shares in the business and a share of the profits.

First Round Capital is a company that specialises in helping tech start-up businesses to grow and succeed. So, not only did they give Uber this large sum of money, they also provided excellent business advice.

In 2019, Travis felt that he needed to raise even more finance so he decided to take Uber public by selling shares on the New York Stock Exchange (NYSE). Uber raised a massive $8.1 billion from selling shares to the public.

However, it’s important to note that it also cost Uber approximately $800 million just to go through the Initial Public Offering (IPO) process.

Questions

- Analyse possible reasons why the creators of Exploding Kittens were unable to use internal finance to raise enough money. (6)

- Analyse the benefits to the creators of Exploding Kittens of using crowdfunding to raise finance. (6)

- Outline one disadvantage for Uber of using share capital to raise finance. (2)

Question 2 and 3:

- Write two separate paragraphs

- Remember to use context!